CleanSpark ($CLSK): When Mining Infrastructure Becomes Scarce Digital Real Estate

Thesis: The shift from cryptocurrency volatility to energy infrastructure scarcity creates asymmetric upside. CleanSpark trades as a Bitcoin miner but increasingly functions as a gigawatt-scale real estate play. With secured grid connections in a world facing acute energy constraints, we see 25-35% upside plus optionality into AI infrastructure within 12 months.

Table of Contents

The Narrative Shift

From Miner to Infrastructure Strategist

The Real Asset: “Finished Sockets”

The Macro Tailwind: Venezuela Changes Everything

Portfolio Metrics & Operational Efficiency

The AI Option: High-Performance Computing Potential

Valuation & The JP Morgan Upgrade

Seven Powers Moat Analysis

The Real Risks

Conclusion: Position Sizing for Infrastructure Thesis

1. The Narrative Shift

Here’s what’s fascinating about markets: they don’t care about your thesis until they do. Then, suddenly, everyone agrees.

For years, CleanSpark ($CLSK) traded as a crypto sentiment play—a leveraged bet on Bitcoin, volatile as a meme stock, misunderstood as a gambling instrument. Enter 2026, and the market is repricing the same asset through an entirely different lens: energy scarcity infrastructure.

The trigger? Venezuela. But let’s not get ahead of ourselves.

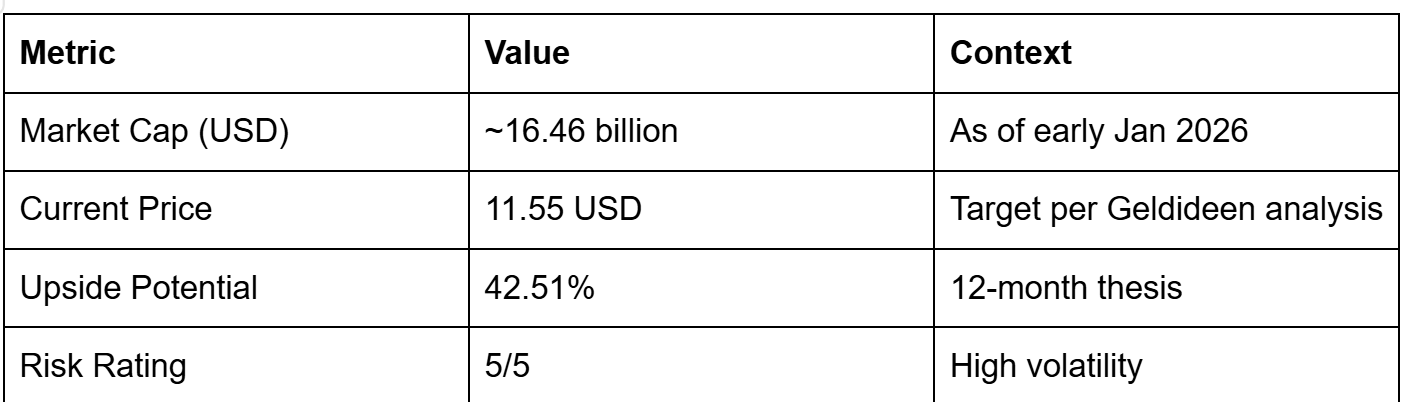

As of early January 2026, CleanSpark is up ~15% year-to-date. This isn’t a crypto rally bump (Bitcoin is rallying, sure, but the narrative is different). JP Morgan upgraded the stock to “Overweight” in late 2025, and their thesis is laser-focused: “The value of a miner is no longer measured solely by hashrate, but by access to gigawatt-scale electricity grids.”

That one sentence should make you sit down.

2. From Miner to Infrastructure Strategist

Most Bitcoin miners are capital-efficient opportunists. CleanSpark is something different: a Microgrid Company That Happens to Mine Bitcoin.

This distinction is critical. While competitors view electricity as a cost center to optimize, CleanSpark treats it as a strategic asset to own. The company’s roots in energy technology (microgrids, distributed power systems) create a fundamental operational difference.

The traditional miner playbook:

Rent power at favorable rates

Mine until rates increase

Relocate to cheaper jurisdictions

Repeat

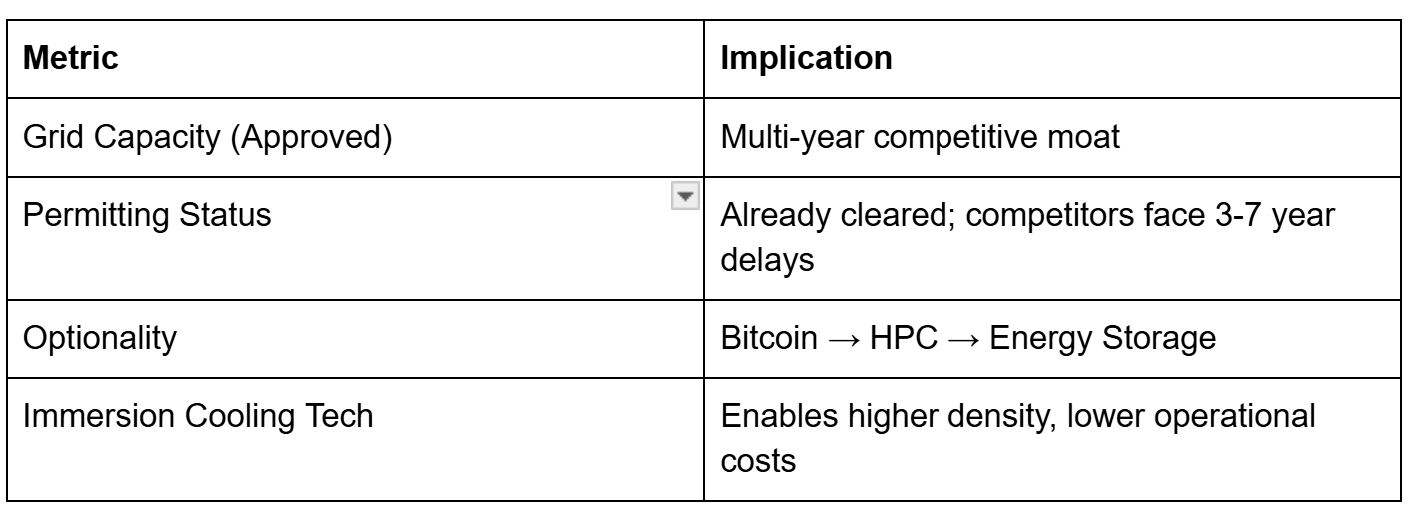

The CleanSpark playbook:

Secure grid capacity approval (takes years for competitors)

Build or contract immersion-cooling infrastructure

Maintain optionality across use cases (Bitcoin, HPC, energy storage)

Control the “finished socket”—the installed megawatt capacity itself

This is the difference between renting a hotel room and owning the hotel.

3. The Real Asset: “Finished Sockets”

Let me introduce you to the concept that makes CleanSpark structurally different: approved grid capacity.

In the U.S., adding electricity to a location isn’t like flipping a light switch. Grid interconnection approvals can take 3-7 years. Environmental reviews, infrastructure upgrades, permitting bottlenecks—it’s a gauntlet. New data center projects, AI infrastructure builds, and mining operations routinely hit years-long queues waiting for grid connections.

CleanSpark has already cleared these hurdles. The company has secured massive approved capacity across multiple U.S. states. JP Morgan specifically highlights 200 megawatts in Texas as a crown jewel. While new competitors are stuck in permitting purgatory, CleanSpark owns “finished sockets”—installed, approved, operational grid connections ready to plug in revenue-generating equipment.

This is digital real estate. And unlike most real estate, the tenant is paying you 24/7/365.

4. The Macro Tailwind: Venezuela Changes Everything

Now, let’s talk geopolitics—or rather, let’s talk about what markets care about: flows and margins.

The recent U.S. intervention in Venezuela is reshaping global energy dynamics. Here’s the simplified version:

Winners:

USA: Gains access to massive Venezuelan oil reserves, strengthening strategic energy control. Lower energy costs reduce inflationary pressure across the economy.

Energy Infrastructure Plays: Cheaper, more stable energy inputs create tailwinds for domestic capacity builds.

Losers:

China: Loses preferential oil access; relies less on Venezuelan reserves or must pay higher prices. The “loans for oil” relationship China spent years building faces renegotiation risk if regimes change.

Russia: Loses influence in the Western Hemisphere and faces additional U.S. sanctions pressure.

What does this mean for CleanSpark?

Lower Energy Costs: More U.S. energy sovereignty = more stable, predictable power pricing. Miners benefit from price stability as much as price level.

Lower-for-Longer Rates: With energy abundance improving, inflation pressures ease. The Fed gets room to cut rates. Lower rates = cheaper capital for hardware expansion. CleanSpark’s $16.46 billion market cap is capital-intensive; cheaper financing directly expands returns.

Electricity Scarcity as a Feature, Not a Bug: AI buildout (everyone’s racing to build data centers), cryptocurrency growth, and electrification of transportation create peak demand. CleanSpark doesn’t have to pray for tight grids; structural demand is already here.

5. Portfolio Metrics & Operational Efficiency

Let’s ground this in operational reality. CleanSpark’s edge rests on two pillars:

Operational Efficiency (”Uptime”)

The company maintains high hashrate-to-equipment ratios through immersion cooling and optimized thermal management

Lower downtime = more consistent revenue

Mining Cost Economics

CleanSpark’s cost per Bitcoin mined is among the industry’s lowest

This matters because it provides margin cushion when Bitcoin volatility compresses prices

Reality Check: Yes, short-term profitability still correlates with Bitcoin price. If BTC crashes 50%, CleanSpark’s margins compress. This isn’t a de-risked play. But the infrastructure assets—the grid capacity—remain valuable regardless of Bitcoin’s price.

6. The AI Option: High-Performance Computing Potential

Here’s where the thesis gets spicy.

JP Morgan explicitly mentions that CleanSpark’s 200 MW capacity in Texas could be redeployed for High-Performance Computing (HPC) workloads. This isn’t science fiction; it’s optionality.

Current State: CleanSpark is operationally a Bitcoin miner.

Future Option: As AI infrastructure builds out, anyone with:

Gigawatt-scale approved capacity

Advanced cooling systems

Low-cost power

Interconnected infrastructure

...becomes a prime candidate for AI accelerator hosting.

The company’s immersion-cooling technology isn’t mine-specific. It’s applicable to GPUs, TPUs, and any compute-intensive workload. Regulators and institutions are increasingly asking: “Who can host our AI infrastructure safely and efficiently?”

Answer: Companies like CleanSpark with secure, approved grid access.

This is the kicker—investors aren’t just buying a Bitcoin miner at a reasonable price. They’re buying a miner with a free call option on AI infrastructure.

7. Valuation & The JP Morgan Upgrade

CleanSpark’s valuation multiples offer perspective:

JP Morgan’s “Overweight” upgrade (late 2025) was the inflection point. Wall Street rarely upgrades miners on fundamental infrastructure merits. That it did suggests the narrative has shifted materially from “crypto play” to “infrastructure asset.”

Key Valuation Consideration: You’re paying for optionality. The core Bitcoin mining business is profitable at current scales. The real value is in the gigawatts of capacity and the optionality to deploy them across multiple use cases.

Think of it this way: If you bought energy infrastructure with a free call option on Bitcoin mining, what would you pay?

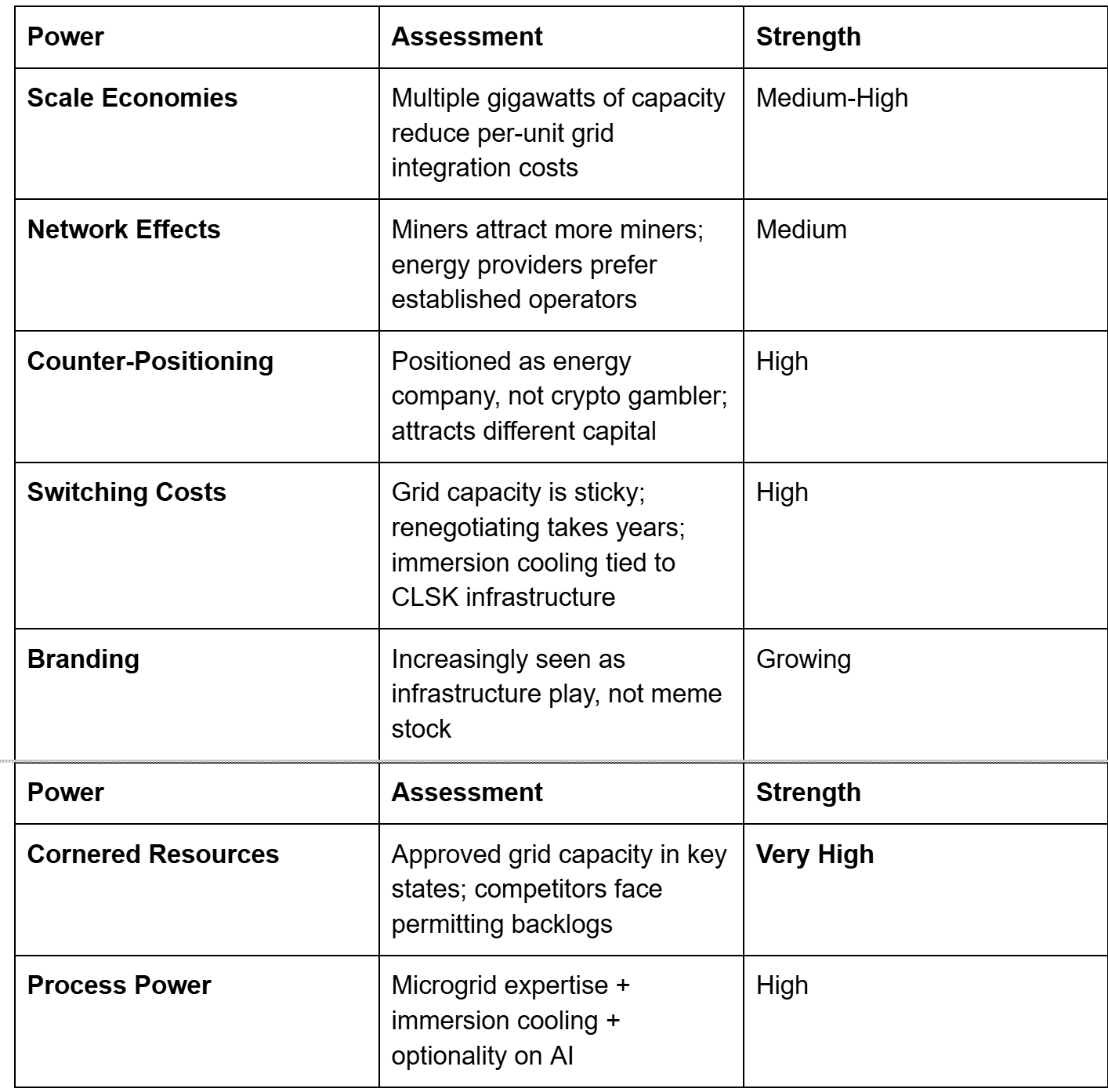

8. Seven Powers Moat Analysis

Let’s apply Hamilton Helmer’s framework to CleanSpark:

The moat isn’t invincible, but it’s real and widening. Competitors can’t easily replicate approved grid capacity. That’s years of permitting work.

9. The Real Risks

Let’s be honest about what can go wrong:

1. Bitcoin Price Collapse

Profitability is still tethered to BTC price in the near term

50% Bitcoin crash = margin compression, though infrastructure assets retain value

2. Regulatory Risk

Bitcoin mining faces increasing regulatory scrutiny in some jurisdictions

Environmental concerns (though immersion cooling improves energy efficiency)

Tax treatment of cryptocurrency operations could shift

3. AI Pivot Execution

The pivot to HPC/AI infrastructure is possible but complex

Hardware requirements differ; software integration challenges; customer acquisition in enterprise markets is different from hashrate markets

4. Competition

Other miners (e.g., Marathon Digital, Riot Blockchain) could pursue similar strategies

Tech companies (AWS, Microsoft, Google) might self-supply AI infrastructure, reducing demand

5. Capital Intensity

Expansion requires significant capex

Rising interest rates would compress returns (though current macro suggests rates are easing, which helps)

6. Grid Volatility

Sustained electricity price spikes could compress margins

Regulatory changes around energy allocation could restrict mining operations

10. Conclusion: Position Sizing for Infrastructure Thesis

Here’s the honest thesis:

CleanSpark is NOT a crypto speculation play. It’s increasingly a constrained energy infrastructure asset with a free option on AI.

For income-focused investors and growth-with-yield portfolios, CleanSpark offers:

High current yield (indirectly through Bitcoin mining cash flow)

Structural demand tailwinds (energy scarcity, AI buildout)

Macro support (lower rates, energy sovereignty)

Optionality (HPC/AI redeployment potential)

Position Sizing Recommendation:

Growth + Income Portfolios: 3-7% (infrastructure play with volatility)

Aggressive Growth Portfolios: 7-10% (optionality is compelling)

Conservative Portfolios: 0-2% or avoid (volatility too high)

12-Month Base Case: 15-20% capital appreciation + indirect dividend benefits (through cash accumulation) = 20-25% total return opportunity.

Bull Case (AI infrastructure thesis validates, grid capacity becomes critical bottleneck): 35%+ upside.

Bear Case (Bitcoin crashes, regulatory headwinds materialize): -30% to -40%.

The asymmetry favors bulls, but the volatility is real.

Final Thought: The “Finished Socket” Thesis

Markets misprice scarcity. For years, miners were priced as if grid capacity was infinite and permission-free. It isn’t.

CleanSpark has done the hard work—years of regulatory navigation, infrastructure investment, and technical development—to own scarce approved gigawatt capacity. Competitors are stuck in permitting queues while CleanSpark plugs in revenue.

That’s not sexy. It’s not a viral meme. But it’s real.

This is a shift from speculation to infrastructure. And infrastructure is how you make real money.

Disclaimer

This analysis is for informational purposes only and does not constitute financial advice. CleanSpark ($CLSK) is a high-volatility asset suitable only for investors with high risk tolerance and a 12+ month investment horizon. Conduct your own research, review the company’s latest SEC filings, and consult a financial advisor before investing. Past performance does not guarantee future results. The geopolitical and macro assumptions underpinning this thesis could shift rapidly.

Follow for more infrastructure deep dives and asymmetric bets.

Written in January 2026. Data sourced from JP Morgan equity research (late 2025), and public company filings.